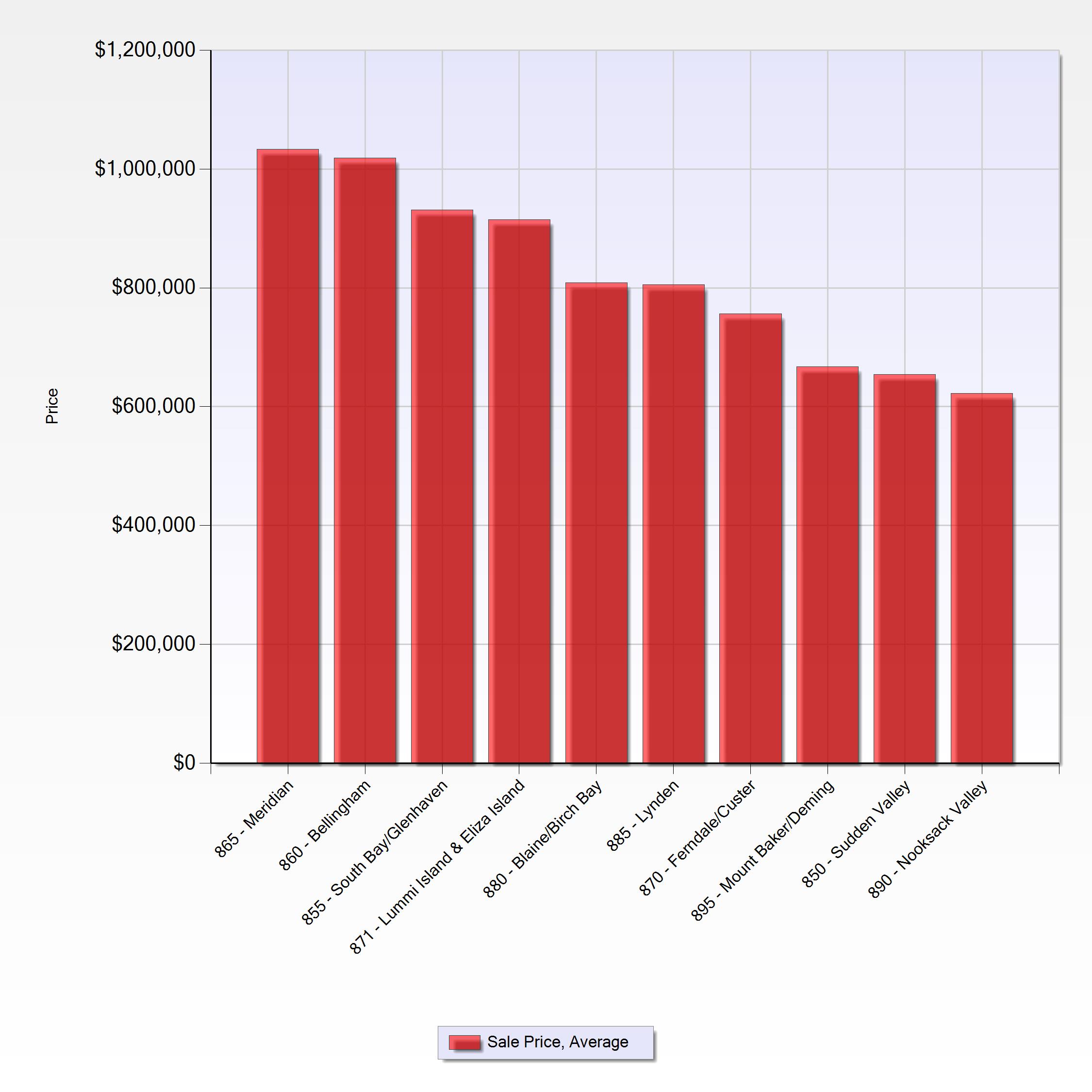

This information on the above graph was generated from our local NWMLS (Northwest Multiple Listing Service) for 3 bedroom/1.75 Bath 1300 to 2000 sq foot homes sold over the last 4 months within Whatcom County has been dynamic, with home prices varying between each community. Whether you are buying or selling, I am here to help make navigating our local market easier.

Whatcom County Real Estate Snapshot: Understanding Average Home Sale Prices by Area

-

Meridian and Bellingham have the highest average sale prices, both exceeding $1,000,000.

- The South Bay/Glenhaven and Lummi Island & Eliza Island areas also show strong average prices, close to $950,000.

- Communities like Blaine/Birch Bay, Lynden, and Ferndale/Custer with prices in the range of $750,000 to $800,000.

- The most affordable prices are found in the Mount Baker/Deming and Nooksack Valley regions, which have prices ranging from approximately $600,000 to $650,000

Market Trends and Outlook for 2026

While expert opinions differ, most forecasts suggest that 30-year fixed mortgage rates will likely average in the low to mid-6% range throughout 2026, with a gradual downward trend. Some predict rates could dip just below 6% by the end of 2026, while others foresee them staying at or slightly above that level.

Key forecast points for 2026:

- Fannie Mae: Predicts a decline to 5.9% by the fourth quarter of 2026.

- Mortgage Bankers Association (MBA): Projects rates will remain higher, ending 2026 around 6.5%.

- National Association of Realtors (NAR): Forecasts a rate of around 6% in 2026.

- National Association of Home Builders (NAHB): Predicts an average of 6.25% by the end of 2026.

- Wells Fargo: Projects rates to average 6.23% in 2026.

- The Mortgage Reports experts: Provide a range of predictions, including an average of 6.1% and a potential drop to 5.2% if economic conditions are favorable, or a range of 5.5% to 6% based on inflation and recession risks.

Factors influencing 2026 rates:

- Inflation trends.

- The Federal Reserve’s monetary policy decisions.

- The strength of the labor market and unemployment rates.

- Yields on the 10-year U.S. Treasury bonds.

- Government deficits and other economic variables.

The forecasts are not guaranteed and are subject to change based on evolving economic data and unfortunately there is no crystal ball to predict the future.

- Growing Inventory: The number of homes for sale has increased, offering buyers more choices and a bit more negotiating power than in previous years.

- Steady Prices: While some prices have softened slightly, the market remains strong, with median prices holding steady or experiencing modest growth.

- A Split Market: The market can be split at the $750,000 price point. Homes priced below this amount are still in a seller’s market, while properties above that threshold are more favorable to buyers due to a higher supply.

What This Means for You

- For Buyers: The increased inventory and stable prices present a good opportunity to find a home with less competition and more room for negotiation.

- For Sellers: While demand remains strong, thoughtful pricing and strategic presentation of your home are more important than ever to stand out in the market.

If you’re thinking about buying or selling anywhere within Whatcom County and would like to discuss what this means for your specific situation, contact me to get a customized market analysis.